Published to clients: June 26, 2025 ID: TBW2067

Published to Readers: June 27, 2025

Email Whispers: December 9, 2025

Public with Video Edition: December 10, 2025

Analyst(s): Dr. Doreen Galli

Photojournalist(s): Dr. Doreen Galli

Abstract:

To strengthen cybersecurity in FinTech, experts emphasize a layered approach that combines technology and human awareness. Rising threats like phishing, smishing, and fraud demand not just better tools but also vigilant, well-trained employees. Embedding security scans into software development, analyzing diverse data signals, and adopting a “defense in depth” strategy are all critical. Ultimately, staying curious, asking the right questions, and embracing evolving technologies—especially AI—can help organizations stay ahead of cyber risks.

Target Audience Titles:

- Chief Technology Officer, Chief Security Officer, Chief Information and Security Officer, Chief Trust Officer, Chief Compliance Officer, Chief Risk Officer

- Head of Product, VP of Product, Chief Marking Officer, Data Protection Officer, Director of Data Protection

- Security Architect, Security Engineers, Penetration Testers, Incident Response & Threat Intelligence Teams

Key Takeaways

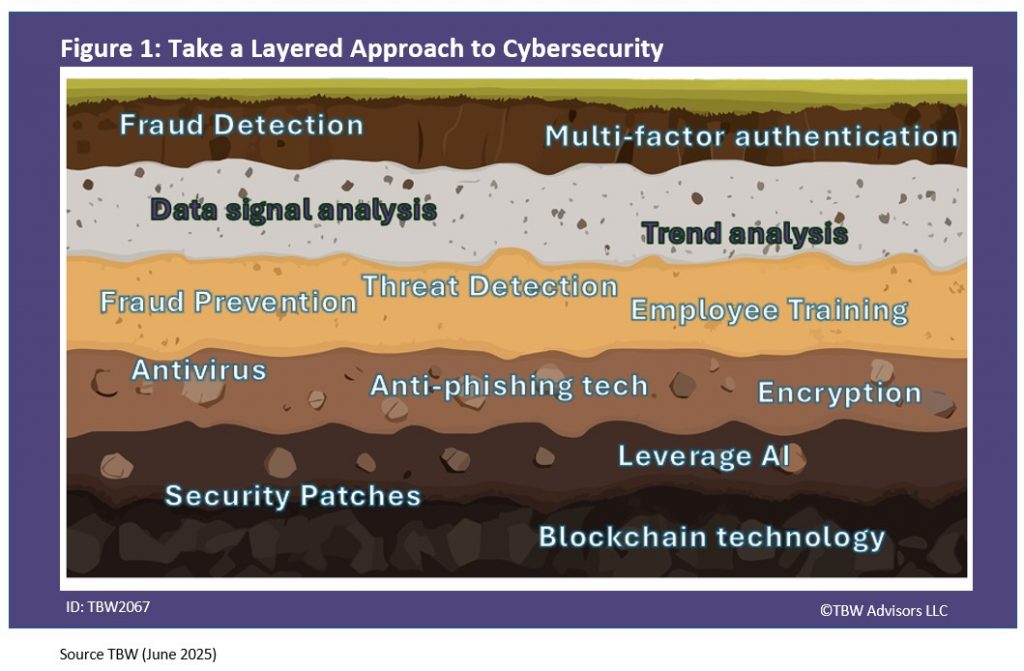

- Adopt a Layered Defense: Use a “defense in depth” strategy—combine multiple security measures and analyze broad data signals to stay resilient against evolving threats.

- Train Your Team: Human error is a top vulnerability. Regular employee training helps prevent phishing, smishing, and social engineering attacks.

- Build Security into Development: Embed security checks directly into software pipelines to catch issues early and reduce risk at every stage of development.

What are the best practices for enhancing cybersecurity in FinTech?

We took the most frequently asked and most urgent technology questions straight to the finance technology experts gathering at Fintech Meetup 2025. This Whisper Report addresses the question regarding what the best practices are for enhancing cybersecurity in FinTech. As SecurityMetrics’s Matt Cowart shared, there is a, “big rise that we’ve seen is fishing and smishing.” Your employees are getting targeted via email and SMS messages. But that is not the only threat. The user or customer angle also brings in cybersecurity issues. Incentiva’s Heather Alvarez shares, “fraud is something that is very big right now and (is something) that we’re trying to combat.”

A Layered Approach

Cybersecurity frequently feels like a game of whack-a-mole. Vulnerabilities seem to pop up in every dimension you explore but there is still hope. As Socure’s Matt Thompson shared, “creating layers and looking at lots and lots of data signal is important for protecting your Enterprise.” This is also known as defense in depth.

What might these layers include? Gitlab’s Field CTO, Joshua Carroll recommends, “making sure your code is secure and doesn’t have vulnerabilities by building the security scanners into your pipelines and do those as you build the software you can save yourself an awful lot of time.” Likewise, SecurityMetric’s Matt Cowart points out that it all, “comes down to training. The weakest link is where hackers get in. Being able to strengthen your entire area – all of your employees making sure they know what to do what not to do is going to be on of the biggest things that keeps your network safe.” Effective training can minimize phishing and smishing as well as positively impact fraud detection during customer interactions.

Thus to enhance your cybersecurity, ensure a depth in defense security strategy and that the strategy includes both technical aspects of your enterprise as well as your humans in the loop. But most important stay curious and keep building. As Incentiva’s Heather Alvarez shared, “ask the right questions .. continuing to push and look for new features look for to AI to help us because there are a lot of Technologies out there.”

If you are evaluating your cybersecurity environment, be sure to book an inquiry for timely advice.

Related playlists

- Conference Whispers: Fintech Meetup 2025

- Conference Whispers: Money 20/20 2024

- Conference Whispers: Identiverse 2024

- Conference Whispers: ISC West 2025

- Q1: Fintech Meetup Playlist – How can we ensure Compliance with evolving regulations?

- Q2: Fintech Meetup Playlist – What are the best practices for enhancing cybersecurity?

*When vendors’ names or quotes are shared as examples in this document, it is to provide a concrete example of what was on display at the conference or what we heard doing our research, not an evaluation or recommendation. Evaluation and recommendation of these vendors are beyond the scope of this specific research document.

Corporate Headquarters

2884 Grand Helios Way

Henderson, NV 89052

©2019-2025 TBW Advisors LLC. All rights reserved. TBW, Technical Business Whispers, Fact-based research and Advisory, Conference Whispers, Industry Whispers, Email Whispers, The Answer is always in the Whispers, Whisper Reports, Whisper Studies, Whisper Ranking, The Answer is always in the Whispers, and One Change a Month, are trademarks or registered trademarks of TBW Advisors LLC. This publication may not be reproduced or distributed in any form without TBW’s prior written permission. It consists of the opinions of TBW’s research organization which should not be construed as statements of fact. While the information contained in this publication has been obtained from sources believed to be reliable, TBW disclaims all warranties as to the accuracy, completeness or adequacy of such information. TBW does not provide legal or investment advice and its research should not be construed or used as such. Your access and use of this publication are governed by the TBW Usage Policy. TBW research is produced independently by its research organization without influence or input from a third party. For further information, see Fact-based research publications on our website for more details.